The "Secret Sauce": Why Our VA Short Sale Files Get Approved Faster (The One Thing Most Agents Miss)

If you ask an average real estate agent how to handle a VA Short Sale, they will probably tell you: "It’s just a lot of paperwork. We gather your pay stubs and bank statements and send them to the lender."

Then, you wait. And wait. And wait some more, while your file sits in a digital black hole at the bank, often getting kicked back weeks later for "missing information."

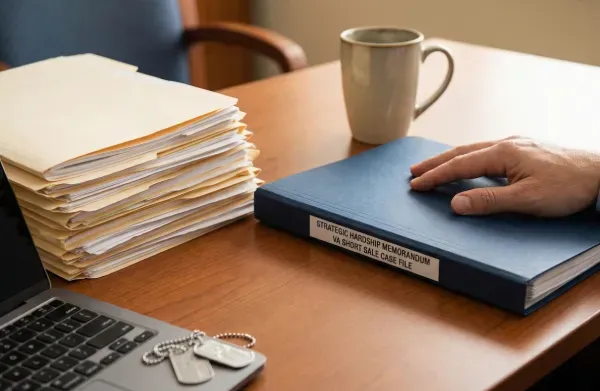

At Anchor & Co, we don't believe in throwing spaghetti at the wall to see what sticks. When we say we "build a clean file" that lenders approve faster, we aren't just talking about neat PDFs.

We are talking about our "secret sauce"—the one crucial element that average agents almost always miss, and the reason our files move to the top of the lender's stack.

The Mistake Average Agents Make: The "Document Dump"

Most agents treat a short sale package like a math problem. They gather the required documents—tax returns, PCS orders, bank statements—staple them together, and email a 200-page PDF to the loan servicer.

They force an overworked, underpaid loss mitigator at the bank to sift through hundreds of pages to figure out why you need help. They dump a puzzle on the lender's desk and ask them to solve it.

This is why short sales take forever. Human beings are reviewing these files, and if you make their job hard, they will put your file at the bottom of the pile.

Our Secret Sauce: The Strategic Narrative

The one thing we do differently—the thing that gets faster approvals—is that we don't just send documents; we tell a data-backed story.

We take the Hardship Letter—often treated as an afterthought by other agents—and turn it into the cornerstone of your entire application.

An average agent tells you to write a letter saying, "I got PCS orders and can't afford the house."

We engineer a strategic narrative that connects the dots for the lender so they don’t have to.

How It Works (The "One Thing" in Action)

We don't let you just write a sad story. We work with you to craft a professional memorandum that ties your documents together into an undeniable argument for approval.

Here is the difference between what an average agent submits versus our "Secret Sauce" approach:

The Average Approach (Gets Ignored):

Hardship Letter: "To whom it may concern, I received PCS orders to California. The housing market dropped here in Jacksonville, and I owe more than the house is worth. My wife also lost her job due to the move. Please approve this short sale." (Attached: 200 pages of unorganized bank statements.)

The "Secret Sauce" Approach (Gets Approved):

We structure the letter like a legal brief. We explicitly reference the attachments to prove our points in real-time.

The Strategic Narrative: "This letter accompanies a VA Compromise Sale request due to Permanent Change of Station (PCS) orders (See Exhibit A: Official Orders).

The borrower purchased the home in 2022 during the market peak. Due to the recent interest rate-driven correction in Onslow County, the current fair market value is now $30,000 below the loan balance (See Exhibit B: Comparative Market Analysis & recent neighborhood solds).

Furthermore, the mandatory relocation to San Diego has increased the family's housing costs by 45%, creating an involuntary negative monthly cash flow of -$800 if they were to retain the North Carolina property (See Exhibit C: Household Budget Analysis and new lease agreement).

Based on VA Guidelines regarding involuntary relocation and severe negative equity, imminent default is unavoidable without this Compromise Sale."

Why This Works

Do you see the difference?

We aren't asking the lender to do the math; we did the math for them. We connected the PCS orders directly to the negative equity, and the negative equity directly to the monthly budget deficit.

When a lender opens our file, they read the executive summary (the hardship letter) and immediately understand exactly why the VA guidelines demand they approve this sale.

It makes it easy for them to say "Yes."

Don't Risk the "Document Dump"

If you are facing a PCS move and are underwater on your home, you don't have time for your file to sit in a black hole because an agent didn't know how to tell your story.

You need an expert who knows how to build a file that demands attention. Let us apply our "secret sauce" to your situation and get you moving to your next duty station stress-free.